How much do you know about Mobile Home Loans? Test your knowledge of the history of Mobile Home Loans, and the multiple financing options available, and even learn the rules that differentiate them from traditional mortgages. Are you interested in taking out a mobile home loan but don’t know where to begin? Have you heard about manufactured home loans but aren’t sure how they differ from other types of mortgages? We know finding facts and figures about Mobile Home Loans can be time-consuming and frustrating, so we put together this list of the top 101 facts, notes, and statistics so you can easily reference them and refer back to them any time in the future. This space is constantly changing, so if you see a fact that is not up-to-date, feel free to let us know. And if you know a stat that we should add, let us know that too!

1. Manufactured Homes Are Built In A factory.

They can be set up at their permanent location on blocks, metal piers, or a permanent foundation. Unlike mobile homes, manufactured homes are not intended to be moved once they’re set up.

2. According To The Housing Act Of 1980, Factory-Built Homes Constructed On Or After June 15, 1976, Are Manufactured Homes.

HUD highly regulates the construction of these homes under the Manufactured Home Construction and Safety Standards (HUD Code).

3. A Chattel Loan Is A Special Type Of Personal Property Loan You Can Use To Purchase A Mobile Home.

These mobile home loans are designed for financing expensive vehicles like planes, boats, mobile homes, or farm equipment, where the property guarantees the loan.

4. Even If You Don’t Own The Land On Which Your Home Will Be Located, You Might Be Able To Secure Financing With A Chattel Loan.

As a result, they are a popular loan option for buyers who plan to rent a lot in a manufactured home community.

5. Some Lenders Offer Chattel Loans For Manufactured Home Purchases That Are Insured By The Federal Housing Administration (Fha), The U.S. Department Of Veterans Affairs (Va), And The Rural Housing Service (Rhs) Through The U.S. Department Of Agriculture.

6. While You May Be Able To Find Lenders That Offer Both Chattel Loans And Traditional Mortgages, These Two Loan Types Differ In A Few Ways.

For starters, chattel loans typically have higher interest rates — 0.5 to 5 percentage points higher on average than traditional mortgage rates. Chattel loans have shorter terms than traditional mortgages, which can translate to higher monthly payments but could also help you pay your debt off sooner. On the plus side, the closing process is usually faster and less restrictive with chattel loans than the closing process you would experience with a traditional mortgage.

7. A Title I Manufactured Home Loan Can Be Used In Several Ways, Including To Finance The Purchase Of A New Or Used Manufactured Home.

It can also be used to refinance a manufactured home purchase, to buy the developed lot on which to locate this type of home, and for a combination purchase of both the lot and the home itself. These funds can also be used to alter, repair or improve a manufactured home.

8. Title II Loans Program Insures Loans That Borrowers Can Use To Finance A Qualifying Manufactured Home, Along With Land, As Long As It Meets The Requirements.

You can only use a Title II loan if you plan to live in the manufactured home as your primary residence — real estate investors need not apply. Other requirements for the home include:

-

Have a minimum floor area of 400 square feet or greater.

-

Be constructed after June 15, 1976.

-

Must be classified as real estate but not necessarily for state tax purposes.

-

Must be built and remain on a permanent chassis.

-

The loan must cover the home and the land on which it stands.

9. Title II Loans Cannot Be Used For Manufactured Homes On Leased Land In Manufactured Home Communities Or Mobile Home Parks.

Down payments on a Title II loan can go as low as 3.5 percent, and terms can last as long as 30 years.

10. Some Lenders Offer Fannie Mae Mortgages To Borrowers Who Wish To Finance A Manufactured Home Through The Mh Advantage Program.

To qualify, you need to satisfy a number of eligibility criteria, including installing a home with a driveway and a sidewalk that connects the driveway, carport, or detached garage. The home must also meet certain construction, architectural design, and energy efficiency standards similar to site-built homes.

11. You May Be Able To Obtain Conventional Financing For A Manufactured Home Through The Freddie Mac Home Possible Mortgage Program.

Qualified borrowers may choose between fixed-rate mortgages (15, 20, and 30 years) and 7/6 or 10/6 adjustable-rate mortgages. You may be able to secure a loan with as little as 3 percent down and, in some cases, use gifted or grant money to help cover your down payment.

12. As With Any Loan, Manufactured Home Loan Rates Will Vary Based On Several Factors.

Your credit score, down payment amount and type of home, and whether you’re buying the land will affect the amount you pay.

13. The Higher Your Credit Score, The Easier It Will Be To Qualify For A Manufactured Home Loan With Competitive Interest Rates.

14. Fha Will Finance With A 500 To 589 Credit Score And 10 Percent Down.

15. Credit Scores Of 580 Or Above Will Only Be Required To Have A Deposit Of 3.5 Percent.

16. The Minimum Credit Score With Freddie Mac Or Fannie Mae Is 620.

17. Various Chattel Loan Providers Will Require A Credit Score Of As Little As 575 Credit Score Or As High As 660.

18. If you want to buy a manufactured home and the land it sits on, you can also get a VA loan.

VA loans are only available to veterans and qualifying active duty service members through the Department of Veterans Affairs. There are many benefits that come with a VA loan, including the ability to put no money down and avoid paying mortgage insurance.

19. Manufactured Housing (Mh) Is A Home Unit Constructed Primarily Or Entirely Off-Site At Factories Prior To Being Moved To A Piece Of Property Where It Is Set.

The cost of construction per square foot is usually considerably less for manufactured housing than for traditional homes constructed on-site. Long known (perhaps somewhat pejoratively) as mobile homes, manufactured housing has come a long way in terms of style, amenities, construction quality, and public perception, though it still can take the basic forms of its roots.

20. A Subset Of Manufactured Housing Is "Modular Homes," Or Homes Divided Into Multiple Sections That Are Constructed Off-Site, Then Assembled Like Building Blocks At The Property.

A manufactured housing unit can be as small as 500 square feet and as large as 3,000 square feet if built in a modular fashion.

21. Manufactured Housing (Mh) Generally Serves A Lower Income Bracket Need In Rural Areas Of The Country.

Young singles and couples, as well as retirees, comprise the core demographic for such housing.

22. If The Manufactured Home Is Purchased Separately From The Land On Which It Will Sit, A Personal Property Loan Is The Most Common Type Of Financing.

Personal property loans carry a higher interest rate than traditional mortgages.

23. If The Manufactured Home And The Land Are Purchased Together, A Traditional Mortgage Might Be Available.

Loan terms and programs vary from lender to lender. The Federal Housing Administration and Department of Veterans Affairs have manufactured-housing loan programs to promote housing affordability among the target demographic.

24. Manufactured Housing Is Constructed On An Assembly Line, Where Each Section Is Put Together In Stages.

Depending on the size of the unit and the extent of customization that a customer requests, the completion process can take several days to several weeks.

25. Wood, Steel, Aluminum, Copper, Granite, Plastic, Glass, Electrical Wires — All The Materials Used For On-Site Home Construction — Go Into A Manufactured Housing Unit.

When a unit is completed, it is loaded onto a flatbed truck and transported to the customer's property.

26. Manufactured Homes Account For 6% Of All Occupied Housing But A Much Smaller Percentage Of Home Loan Originations, According To A Report Issued By The Consumer Financial Protection Bureau (CFPB).

Whatever you call them, one reason why loan originations are so low is that people living in manufactured homes tend to be “financially vulnerable,” as the CFPB puts it—older adults or people whose self-reported incomes were in the lowest income bracket and who tend to be offered less-than-favorable rates and terms on any type of loan.

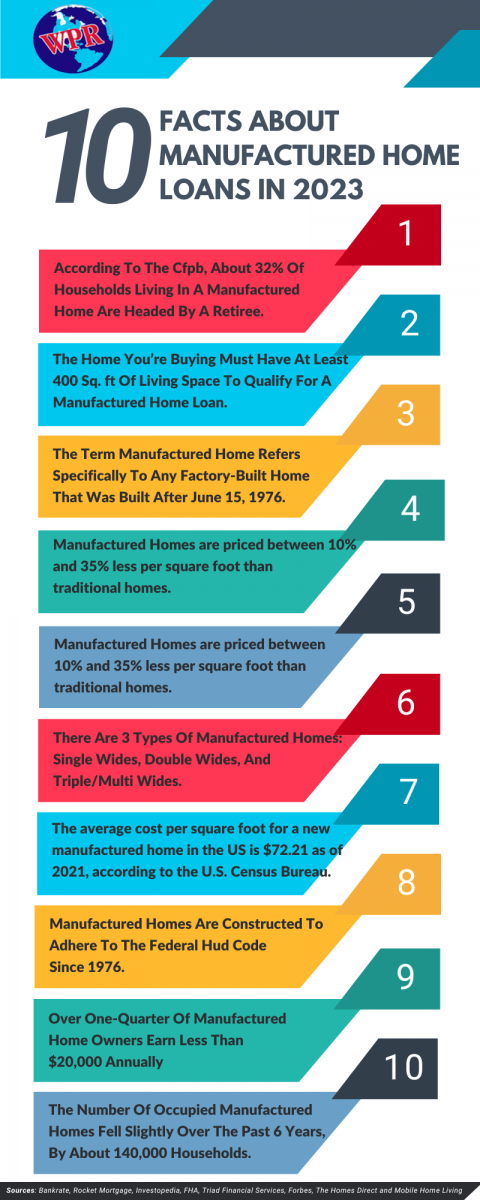

27. According To The Cfpb, About 32% Of Households Living In Manufactured Home Are Headed By A Retiree.

They have about one-quarter of the median net worth of other households. Manufactured homes aren’t always eligible for a conventional mortgage because the prospective homeowner doesn’t own the land on which they are located.

28. In 2013, 86% Of Borrowers With A Manufactured Home Used A Chattel Loan, Despite 65% Owning The Land On Which They Live, Which Would Have Qualified Them For A Conventional Mortgage.

Fortunately, the percentage of borrowers with this loan type improved dramatically, according to a CFPB report from 2021 that lists the rate of borrowers with chattel loans at 42%.

29. If You Can Afford A 10% Down Payment, Then The Minimum Credit Score Required For A Federal Housing Administration (Fha) Loan On A Mobile Home Is 500.

30. Loan Options Like U.S. Department Of Veterans Affairs (Va) Loans, U.S. Department Of Agriculture (Usda) Loans, And Federal Housing Administration (Fha) Loans Are Available On Manufactured Homes.

31. The Fha Has A Maximum Loan Amount That It Will Insure, Which Is Known As The Fha Lending Limit.

These loan limits are calculated and updated annually and are influenced by the conventional loan limits set by Fannie Mae and Freddie Mac. The type of home, such as single-family or duplex, can also affect these numbers.

32. For 2023, The Fha Floor Was Set At $472,030 For Single-Family Home Loans.

This minimum lending amount covers most U.S. counties.

33. For 2023, The Fha Ceiling Was Set At $1,089,300 For Single-Family Home Loans.

This represents the highest amount that a borrower can get through the FHA loan program. It applies to high-cost areas in the United States.

34. Manufactured Homes Meet Federal Guidelines.

One of the biggest misconceptions about manufactured homes is that they somehow fall short of traditional housing in terms of building quality. In truth, manufactured homes have been held to HUD standards since 1976, and must meet all federal guidelines when built at the factory.

35. Manufactured Homes Are For Long-Term Housing.

Many people believe that manufactured homes are only good for temporary living or regular movements. In truth, moving a manufactured home can be quite costly, in fact, the home is usually placed on a permanent lot and secured for the rest of its life. Another unknown fact, many builders of manufacturing homes now offer advanced skirting products that make the home look exactly like a site-built home as well.

36. Manufactured Homes Are Different From Modular Homes.

A modular home shares some characteristics with a manufactured home in that the major components are all assembled at a factory and shipped to their final destination. However, with a modular home, the pieces arrive separately and must be connected and assembled individually. The pieces do not stay attached to a trailer chassis in the end.

37. Manufactured Homes Are Environmentally Friendly.

Manufactured homes typically produce far less waste than other housing types because of their size and structure. In addition, by meeting current HUD regulations, they also perform admirably when it comes to energy efficiency. Homeowners can feel confident that their manufactured home is a safe option for the environment that minimizes damage to our natural resources.

38. Manufactured Homes Are Easy To Customize.

Among the greatest benefits of manufactured homes is the fact that you can fully customize any design you like. From the floor layout to the countertop materials, the sky is the limit. While some people believe that these homes are reserved only for low-income buyers, the truth is that there are many premium-quality manufactured homes on the market that look just like traditional construction in terms of material and interior design. In addition, if you are comparing custom builds, a manufactured home can be completed in a fraction of the time of a site-built house.

39. Manufactured Homes Exist Outside Of Parks.

The negative stigma that has followed trailer parks can be readily washed away with today's modern manufactured homes. In fact, the vast majority of buyers today are placing their homes on independently owned land and installing the homes to look like any traditional neighborhood. While you can lease land in a park to place your home, it is certainly not the only option available to you.

40. Manufactured Homes Are Easier To Finance With Land.

Mortgage companies see manufactured homes in an odd way. If the home is not attached to a piece of land, it is not technically real estate. Instead, it is chattel or private property. Loans for private property differ from mortgage loans in many ways.

41. The Home You’re Buying Must Have At Least 400 Square Feet Of Living Space To Qualify For A Manufactured Home Loan.

Most manufactured homes, especially double-wide or modular homes, easily meet this requirement.

42. Fannie Mae’s Conventional Loan For Manufactured Homes Requires The Home To Have At Least 600 Square Feet Of Living Space.

43. The Term Manufactured Home Refers Specifically To Any Factory-Built Home That Was Built After June 15, 1976.

This is when the U.S. Department of Housing and Urban Development (HUD) instituted stricter guidelines around how mobile homes and other factory-produced homes could be constructed.

44. Unlike Conventional Building Codes, The Hud Code Requires Manufactured Homes To Be Constructed On A Permanent Chassis (A Base Frame With Wheels) And Be At Least 320 Square Feet.

Once delivered to the final location, the wheels are removed and the chassis is placed on piers, masonry crawl spaces, or a concrete foundation.

45. Manufactured Homes are priced between 10% and 35% less per square foot than traditional homes.

Despite some of the old, negative stereotypes that still exist for manufactured homes, studies show that they generally retain or appreciate in value over time.

46. A mobile home refers to manufactured homes produced before June 15, 1976. As the name implies, these homes could be moved around.

Mobile homes received a bad reputation thanks to early models, which often weren’t built with quality in mind and depreciated in value quickly.

47. According To April 2020 Data From Homes Direct, The Average Cost Of A New Single-Wide Manufactured Home (Approximately 500 To 1,200 Square Feet) Was $64,500, While The Average Cost Of A New Double-Wide (Approximately 1,000 To 2,200 Square Feet) Was $120,300.

48. Rent Costs For Manufactured Homes Vary Depending On Location.

In Missouri, you can expect to pay as little as $185 per month, while in California, the average rent is $707.

49. The U.S. Department Of Agriculture (Usda) Also Offers Manufactured Home Loans.

The home must be considered real property, at least 400 square feet and permanently fixed to a foundation to qualify. To qualify for a USDA loan, the site must also be considered rural according to USDA guidelines, and the home must be less than a year old.

50. Freddie Mac Also Offers Conventional Mortgage Loans For Manufactured Homes Under The Choicehome Program.

You can put down as little as 5% as long as you have good credit and use the loan for both primary and second homes; investment properties aren’t eligible.

51. Manufactured Homes Are Typically More Affordable.

Manufactured homes are often much cheaper than stick-built homes. It’s also easy to customize a home to fit your particular budget and lifestyle needs. Today, it’s possible to buy a manufactured home that has all the amenities and comfort of a traditional home for a fraction of the cost.

52. Manufactured Homes Pose Efficiency.

Manufactured homes can be built and installed quickly. The construction process is also streamlined, allowing for fewer mistakes, damage, and delays. Manufactured homes are also highly energy efficient thanks to the HUD code, which requires them to be constructed with energy-saving features.

53. Manufactured Homes Are Versatile.

Manufactured homes make great starter homes that you can always expand later. As your needs change or your family grows, it’s possible to add on modules. And though most manufactured homes are no longer meant to be mobile, it may be possible to move yours to a different location in the future.

54. Financing For Manufactured Homes Can Be Difficult To Secure.

Not all manufactured homes qualify as real property, which means you might not be able to secure a traditional mortgage or manufactured home loan. You may end up having to pay higher interest rates to finance a manufactured home purchase.

55. Manufactured Homes Have Location Limitations.

Manufactured homes don’t come with their own lot to stand on. To live in your home, you’ll also need to secure a plot of land for it, whether that’s in a manufactured home community or a standalone lot. And that means added costs on top of the home.

56. Manufactured Home Have a Negative Stigma.

There is still a negative connotation to manufactured homes and parks, even though the safety and aesthetics are miles above what they were several decades ago.

57. There Are 3 Types Of Manufactured Homes: Single Wides, Double Wides, And Triple/Multi Wides.

58. Single Wide Manufactured (Mobile) Homes Have An Average Size From 500 To 1200 Square Feet Which Include 1-2 (Rarely 3) Bedrooms, And 1-2 Bathrooms.

59. Double Wide Manufactured Homes Have An Average Size From 1000 To 2200 Square Feet Which Include 2-3 Bedrooms And 2 Bathrooms.

60. Triple/Multi Wide Manufactured Homes Have An Average Size From 2000+ Square Feet Which Includes 3+ Bedrooms, And 2+ Bathrooms.

61. All Manufactured Homes Have Specific Energy Efficiency Standards Set By The Federal Government In The HUD Code.

Manufactured homes built after October 1994 are required to be insulated to the geographic zone they are designed for, must have double-pane windows, and must have ventilation fans in kitchens and bathrooms.

62. Manufactured Homes Are Moveable But It Will Take Specialized Trucks And Equipment So It Isn’t Easy And Cheap.

Only Manufactured homes can either be placed on a lot with a permanent foundation or on leased or owned land.

63. Manufactured Homes Can Be Sited On A Parcel Of Land Just As A Home Can Be Built There.

In this case, they can be designed so as to be indistinguishable from conventional site-built homes. Manufactured homes can also be placed in a land-lease community where the home is owned and placed on leased land.

64. Manufactured Homes That Are Not Attached To Owned Land Are Considered Chattel.

65. Chattel Is A Real Estate Industry Term Used To Describe Property Not Legally Tied To The Land Where It May Be Permanently Sited.

Loans on chattel may have fewer financing options and have higher interest rates than conventional property loans, but there are companies that offer competitive rates and terms.

66. There Are Two Main Ways To Finance The Purchase Of A Manufactured Home.

Conventional mortgages are available to qualified buyers who purchase their manufactured home along with a parcel of land. Chattel loans, or personal property loans, are available for homes located on land the buyer doesn’t own, such as a manufactured home community, or when only the home is being financed and not the land.

67. A Manufactured Home Loan Is A Type Of Loan That’s Specifically Intended To Be Used To Finance A Manufactured Home, Also Called A “Mobile Home.”

It’s important to know, though, that these loans are not necessarily available for all “mobile homes.”

68. Manufactured Home Loans Are Usually Issued For Single And Double-Wide Mobile Homes That Are At Least 540 Square Feet, Located In Approved Mobile Home Parks, Are On An Approved Foundation, And Are Taxed As Real Estate, Rather Than Vehicle.

This makes them distinct from wheeled vehicles that are also homes.

69. The average cost per square foot for a new manufactured home in the United States is $72.21 as of 2021, according to data from the U.S. Census Bureau.

However, manufactured home costs vary by location and size of the home, so expect to find a broad range in prices.

70. Depending On The Cost Of The Manufactured Home You’re Buying, A Personal Loan May Be An Option.

Personal loans generally go up to $50,000, however, some lenders issue loans up to $100,000. These loans come with fixed rates, and terms are usually between two and five years. However, personal loans typically have higher interest rates than mortgages and auto loans. Exact personal loan qualifications vary by lender, but most will usually review your credit score, income, and other financial details.

71. In 2021, The Average Manufactured Home Price Was $108,100, But A Single-Family Home Cost An Average Of $365,904 (Excluding, In Both Cases, The Value Of The Land).

72. Manufactured Homes Represented About 9% Of New Single-Family Residential Buildings In 2021, According To Data From The Us Census Bureau’s Most Recent Manufactured Housing Survey.

73. Manufactured Home Can’t Be Bought With The Original Intent To Use It As A Rental Or Investment Property.

It’s another reason why this affects appreciation. When you go to sell your home, not only is there a limited pool of buyers but you can’t sell to investors.

74. Manufactured Home That Is Located On A Leased Lot (Like A Mobile Home Park) Cannot Be Purchased.

There are some exceptions. An example would be if the lot is an approved condo project, in which case there are some programs that are very interesting. But, by and large, most condo projects are not going to be approved, so most mobile home park acquisitions cannot be done using conventional financing.

75. If You Own The Land, Financing A Manufactured Home Is Fairly Similar To Financing A Traditional Home.

You’ll need a credit score in the mid-600s, a down payment of 10%-to-20% (as low as 3.5% with an FHA loan), and income that is roughly one-third the mortgage.

76. While 80% Of Manufactured Homes Are Owned By Their Inhabitants, Only 14% Of Those People Also Own The Lot On Which Their Unit Is Placed, According To Housing Assistance Control, A Nonprofit Organization That Tracks Affordable Housing.

77. About 97% Of The U.S. Land Mass Is Usda Loan Eligible, An Area Encompassing 109 Million People.

78. The Downside To A Usda Loan Is A Guarantee Fee Of 2% Is Added To The Total Loan Amount, And An Annual Fee Of .5% Gets Added To Your Monthly Payment.

79. A Study By The Consumer Financial Protection Bureau Found That The Annual Percentage Rate, Or Apr, Was 1.5% Higher On Chattel Loans Than on Standard Mortgages.

Loan processing fees, however, were 40-50% lower.

80. The Average National Price Of A New Manufactured Home Is $81,700, While The Average National Price Of A New Site-Built Home Sold In 2020 Was $287,465, According To Homeadvisor.Com.

81. According To The Balance Money, More Than 17.5 Million People In The U.S. Live In Manufactured Homes.

82. The Manufactured Housing Industry Produced 105,772 New Homes In 2021, Approximately 9% Of New, Single-family Home Starts.

83. According To Manufacturedhousing.Org, The Average Sales Price Of A New Manufactured Home Without Land Is $108,100.

84. According To Manufacturedhousing.Org, 49% Of New Manufactured Homes Are Placed On Private Property And 51% Are Placed In Manufactured Home Communities.

85. Manufactured Homes Are Constructed To Adhere To The Federal Hud Code Since 1976.

The HUD Code, regulates home design and construction, strength and durability, fire resistance, and energy efficiency. HUD revised the building code in the early 1990s to enhance energy efficiency and ventilation standards and to improve the wind resistance of manufactured homes in areas prone to hurricane-force winds.

86. Approximately 22 Million People Live In Manufactured Or Mobile Homes In The United States, According To The Manufactured Housing Industry Statistics.

87. Homeowner Stats Indicate 56.4% Of Mobile Homeowners Have Lived In Their Current Home For More Than 10 Years.

88. 960 Square Feet Is The Average Size Of A Lot Plot For A Mobile Home.

89. Computer Aid Planning Allows Manufacturers To Reduce Material Waste During The Production Process – 3d Printing To Grow $14 Billion By 2020.

90. Up To 70% Of Manufacturing Materials End Up As Scraps.

91. 17.7 Million Americans Live In Mobile Homes Which Is About 5.6% Of The American Population.

92. 39% Of Deaths Caused By Tornadoes In The Last 20 Years Were Mobile-Home Residents.

93. The Number Of Fire Deaths And Damage Has Decreased By About 60% Since 1980.

This proves that we are getting better at building mobile homes that are safer and can withstand disasters such as house fires.

94. Mobile Homes Save Over 40% On Housing Costs.

If we look at the nationwide housing comparison, the cost for a mobile home is about $564 a month as opposed to the average $1 057 per month for a site-built home or an apartment in America.

95. Mobile Homes' Median Household Income Is $34, 000 Whereas Non-Mobiles Income Reaches $59, 700.

When it comes to saving money, you need to be aware of what mobile home living costs compared to how much it comes to live in a built home in America these days.

96. There Are 1253 Manufactured And 4114 Site-Built Homes In New Mexico In 2017 Alone Which Comprises A 27% Change In New Manufactured Housing Since 2009.

97. New Mexico And Nebraska Are The Top 2 States That Have Increased The Number Of Mobile Homes In America Since 2009.

The average mobile home price in 2017 was $ 75, 200.

98. Manufactured Housing Represents 6.3% Of The Nation’s Housing Stock But Is A Higher Share Of Housing Stock In Rural Areas.

While site-built single-family homes represent about 80% of housing stock in rural areas, manufactured housing represents about 14% of the stock. Apartments trail a distant third, representing only about 6% of the stock in rural areas.

99. While Most Manufactured Homes Are Owned, With 4.8 Million Homes Occupied By Owner Households, There Are Also 1.9 Million Units Occupied By Renter Households.

In 2018, there were another 680,000 homes classified for seasonal or recreational use and another 860,000 units which were vacant.

100. The Number Of Occupied Manufactured Homes Fell Slightly Over The Past Six Years, By About 140,000 Households.

This is concerning because there is a dearth of affordable housing in the U.S. today, and manufactured homes tend to be occupied by lower-income households.

101. Over One-Quarter Of Manufactured Home Owners Earn Less Than $20,000 Annually And Two-Thirds Earn Less Than $50,000 Annually.

By contrast, about a third of site-built homeowners earn less than $50,000 annually.

Sources

- Bankrate

- Rocket Mortgage

- Investopedia

- Investopedia

- FHA

- Triad Financial Services

- Forbes

- The Homes Direct

- Mobile Home Living

- Manufactured Housing Institute

- Community West Bank

- Lendingtree

- The Mortgage Brothers

- Incharge

- The Balance Money

- Manufactured Housing

- Movity

- Fannie Mae

.jpg)